Introduction

When it comes to investing in the stock market, there are countless investment tools, vehicles, and markets. One of the most interesting (albeit exciting) opportunities is in the options market. An American type option is a contract that allows (but does not require) and investor to buy or sell an underlying security, ETF, or index at a predetermined price over a predetermined period of time. Options give the investor more leverage as each options contract is equal to (the right to buy) 100 shares of the underlying instrument at a particular price.

“Risk comes from not knowing what you’re doing.” - Warren Buffet

“Risk comes from not knowing what you’re doing.” - Warren Buffet

Options in another light

Prior to talking about stock options, it helps to hear a real-world example. Suppose an apartment complex is valued at $1 million. An investor gives the owner $100,000 and in exchange can purchase the apartment complex for $1.2 million any time within the next 4 years. If the apartment complex goes up in value to be worth say $1.5 million, the buyer of the option would buy the building for $1.2 million and resell it for $1.5 million, reaping a $200,000 profit ($1.5 million – [$100,000 + $1.2 million]). If the apartment complex does not increase by enough money, the option will not be exercised and the buyer loses his $100,000.

Options terminology, intuition, and profit margins

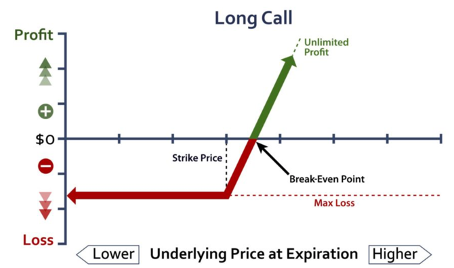

Before going in depth on options, a few key terms need to be defined. First are the two types of options that can be bought or sold – a call option and a put option. A call option is purchased if the investor expects the price of the underlying instrument to increase. The buyer of a call option pays a predetermined price for the right to purchase 100 shares of the underlying instrument for every contract they purchased at any point prior to the expiration date at the predetermined strike price. If the option can be exercised for a profit, then the buyer should exercise the option. On the other hand, if the option cannot be exercised for a profit, the buyer will not exercise the option and the seller of the call option will profit the amount the buyer originally paid for the option. This is great because the buyer’s maximum loss is the amount paid for the options contract. In theory, the buyer has unlimited potential for profit.

The situation for a put option is basically the same except the buyer of a put option is expecting the value of the underlying instrument to decrease. Buying a put option gives the investor the option to sell the underlying instrument at the strike price of the option, so if the underlying instrument drops enough they essentially buy it at the new value and sell for the old, predetermined value for a profit.

Conclusion

While there is much more to talk about with options such as what goes into an options value (intrinsic value, time value, volatility) as well as very interesting strategies that combine puts and calls (protective straddle, iron condor, butterfly spread, and many more), this introduction should give you a good sense of how options trading works and if it is something you may want to learn more about and add to your investment strategy.

Disclaimer

DO NOT BASE ANY INVESTMENT DECISION UPON ANY MATERIALS FOUND ON THIS WEBSITE. We are not registered as a securities broker-dealer or an investment adviser either with the U.S. Securities and Exchange Commission (the “SEC”) or with any state securities regulatory authority. We are neither licensed nor qualified to provide investment advice. We are just a group of students who diligently follow industry trends and current events, then share our own advice, which reflects our personal position in the market.